While writing the post on the upgrade of the Hornsdale Power Reserve, I became curious how South Australia balances its grid. Looking into the data, it became pretty clear that it aren’t the batteries that doing the balancing. According to the fuel mix data of AEMO, the battery storage output is insignificant compared to the huge swings in output of solar and wind power.

There are several balancing strategies possible. For example, in a previous series on the German energiewende, I found that Germany’s strategy is to use fossil fuels (gas, coal and even lignite) when there is not enough solar & wind and export the surplus to the neighboring countries when there is too much solar & wind.

South Australia also has a high share of solar and wind, so how do they do it?

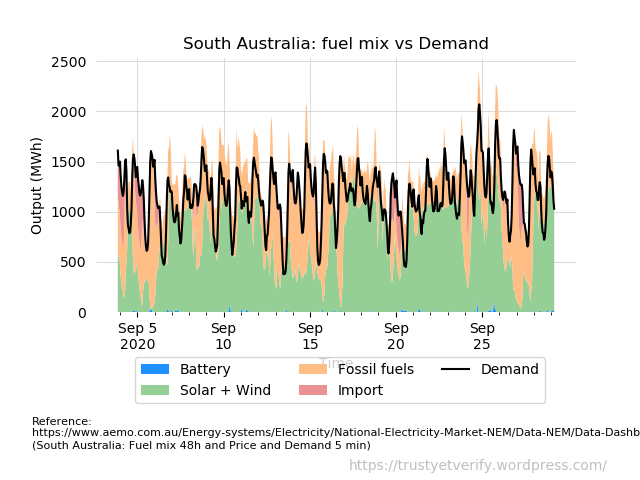

There is a lot of data of the Australian grid on the AEMO website. Not only the fuel mix data that I used in the previous post, they also have other data like spot prices, scheduled demand, scheduled production and import/export balance. Unfortunately, the finer-grained (hourly) data is only for the last few days, so I say myself collecting this data in the last few weeks and this is an overview of almost one month’s worth of data (click to enlarge to get a clearer view):

It is clear that there are huge swings in output of solar and wind. There are times when output of solar and wind is next to nothing (September 5, 15, 16 and 27), but there are also times when the output of solar and wind exceeds demand (September 4, 6, 17 20, 21, 22, 23 and 28).

As seen in previous two posts, the output of the batteries in South Australia is pretty pathetic and this is also clearly visible here (the blue colored blips glued to the x-axis). These batteries clearly have no function in the balancing of those swings in output of solar and wind (their function in the grid is frequency control and they make quite a buck doing so).

There is also a difference in how these situations are handled. When there is not much solar and wind, natural gas is jumping in, sometimes supported by import of electricity from Victoria. The production and import fit demand rather snugly. This is not the case when there is a lot of solar and wind. Although natural gas then powers down, these are the times when electricity is exported to Victoria.

The result is that in this small sample, roughly 21% from all electricity that was moved between South Australia and Victoria was imported into South Australia and 79% is exported to Victoria. That makes South Australia a net exporter.

South Australia apparently uses the same strategy as Germany. They both use fossil fuels (natural gas) to fill in the gaps and they export their surplus production to their neighbors when there is a lot of solar and/or wind.

This difference in import versus export in both countries is I think a consequence of the dynamics explained in previous post. On the one hand, solar and wind in South Australia can potentially provide next to nothing (even at peak demand) and this means that the need for backup doesn’t decrease much when adding more solar and wind capacity. If that need can be met by natural gas together with some import, then it doesn’t matter much that the need for backup doesn’t decrease much. On the other hand, solar and wind in South Australia can potentially provide all needed electricity (even at peak demand) and this capability will grow ever faster when adding more solar and wind capacity.

Combine a slowly decreasing need for backup (that currently can still be met) with an ever faster growth of peak production (generating surplus energy that they need to get rid of in order to protect their grid) and it shouldn’t be a big surprise that both countries became net exporters of electricity. They are net exporters, not because they are reliable energy producers, but as the result of adding more intermittent power sources on their grid without having the ability to balance that power.

via Trust, yet verify

October 2, 2020 at 03:22PM

You must be logged in to post a comment.